I never budgeted until I graduated from college, and never took it seriously until I started law school. I really could have used it in college, because I definitely had a few overdrafts... Very embarassing now that I'm so careful about my finances!

After I graduated in 2012, J and I moved in together and rented an apartment, which is when I started thinking about having an actual budget (even if I didn't take it super seriously yet). It was the first time I really had to make sure I had enough money in my account to pay rent each month.

When I started law school, it was the first time I started seriously budgeting. Since I only had limited funds to live on (as well as to actually pay for school), and we weren't allowed to work first semester, it became clear that I really needed to work on a budget, and then stick to it!

When I first started looking for tips, I found a downloadable budget on a blog I already followed - Words of Williams. I edited it (pretty drastically) to fit my own needs. For example, I don't have a mortgage or car payments, I don't own a house, and since I'm living on loans right now (ew), I'm not saving my loan money for retirement or funds for our potential future kids.

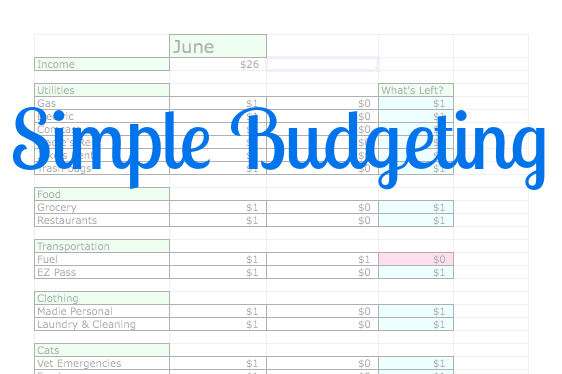

Here's the budget spreadsheet I'm currently using: (Click to Download)

Obviously the real numbers aren't there - I put numbers in just to show how the bottom area works.

At the bottom, my budget shows how much of the budget I used for the month, and how much is left. By that, I mean if my budget was $100 and I only put in $90 in the first column to be used, I still have $10 left that could be used to save for the next month, put away, used in a category, etc.

The next area is how much I've spent for the month and how much I have left. If I've budgeted for $100 but only spent $90 at the end of the month, then I can note that for the next month and try and budget for less - which is always my ideal choice! The more I can save, the better!

Simple Budgeting:

My biggest tips on budgeting is to try it out for the first month, keep track, and just see what you spend. It can be a little scary, but it can be really eye-opening to see where you're spending your money the most. You can cut down and wiggle things around the next month!

- I keep my utilities, payments, and rent (basically, "apartment" stuff) up at the top, because they're arguably the most important payments I make. They're necessary (yes, even the trash bags - Concord makes you buy these special ones or the trash guys won't pick it up!).

- Next, I have my food budget. We've been trying to keep our food payments around $200 or lower each month. We went over a little bit this past month, but it's pretty understandable since it's the first time we've lived together for the past two years! In general, it's definitely what I spend the most on besides rent payments, because it's what I care the most about. I separate my grocery and restaurant budgets for the month, and definitely try to eat at home if we can help it!

- I really only have two transportation areas: Fuel and my EZ pass! I just got an EZ pass a few months ago, so it's a new payment for me.

- I used to spend a lot more on clothing, but I've really cut down on that this year. It's so easy to but online from places like H&M, but I already have so many clothes - ones that I never wear! Cutting down here has helped a lot.

- Cats, tho... I always budget at least $10/mo for vet emergencies that I hope I never have to use, because I don't want to be surprised and panicked by a vet bill. Food and litter are givens, and, along with the vet emergency category, I want to have an "other" section in case they need something unexpected. Always expect the unexpected with pets.

- Oh, my "Personal" section... This is where I put things like my Netflix bill, hair cuts, school costs (like supplies, books, etc.), sending mail, gifts for family and friends, and things that don't really fit in any other category.

- My Entertainment section is probably a lot "lamer" than most other people and law students' sections... because I hardly need any money for entertainment. J and I don't go out for drinks (too expensive), so it's mostly for date nights or going to the movies with friends. I remember when I first started school that my budget for the month was $50 for entertainment, and someone else at school was shocked, because he said he spent $50 each weekend on drinks. Eeek!

You also need to figure out where you're spending your money! Like when I edited my spreadsheet, I had vastly different categories. Your budget has to work for you, so don't be embarrassed by a category. If you spend $20/mo on music (ahem, J), that's going to be a category for you. If you buy a lot of makeup, create a category for it!

You should also really think about why you're budgeting. I started because it was important to me to see where I was spending my money and to make sure I could survive in law school. It actually stresses me out less to keep track, because I know, 100%, what I can afford to do. It's stressful when you're figuring out your ultimate monthly budget, but once I figured it out, it saved me so much stress in the long run! But just because that's my reasoning, it doesn't mean that's going to work for you. I have friends who just "generally" figure it out, and as long as that works for them, that's great. I need something a little more concrete.

Think about how you're spending your money. When I was adjusting my budget for living with J (and we were trying to create one budget for the two of us), one thing we debated about for a long time was my "hair care" category. I was spending about $45-50 every month and a half on my hair cut, and J thought that was ridiculous since he gets his hair cut at Great Clips. I tried to explain to him that when I get my hair cut, it's also about the atmosphere and the quality, not just getting a trim. Needless to say, neither of us were budging... so I agreed to go to a different salon in town where a haircut is $10-20 cheaper. It made J feel better, and I'll have more money for the rest of the month!

Who are you budgeting for? Since J and I aren't married yet, we don't have a joint bank account. When we moved in together again, I tried to make a joint budget... and failed, miserably. I realized after trying to join the budgets one night that it would be a lot easier for me to just deal with my own money than to try and regulate J's money too, so I decided to just budget for myself. J certainly doesn't mind - I'm a lot stricter about the budget and where my money goes, so I think he likes the temporary freedom, haha.

I always felt like budgeting was lame, like being a killjoy. Now that I do it all the time, I realize how simple it actually is and how much stress it saves me each month! Do you budget?

Thank you, thank you for this post!!!!!!! I needed this! I downloaded the spread sheet and am excited to start using it :) Thank you again Maddie! xo

ReplyDeletecloudychase.blogspot.com

Ahhh I'm SO glad this was helpful for you! :) You're welcome, and enjoy! <3

Deletexo Madie